1900 bir form|An Ultimate Guide to Loose Leaf Books of Accounts: Application : Baguio Learn how to use BIR Form 1900 and other documents to register for Loose-Leaf Books of Accounts online via ORUS. Find out the requirements, steps, and recent updates for . Date: 15 au 18 mars . Lieu: Parc des Expositions, Colmar. Quoi: Le salon Énergie Habitat, un événement local de premier plan, rest à la pointe des dernières tendances et innovations en matière d’énergies renouvelables.Réunissant des exposants experts dans leurs domaines, cette exposition présente des solutions parfaitement .

1900 bir form,Learn how to use loose leaf books of accounts, a BIR-approved method of recording transactions electronically and printing them out. Find out the requireme.Learn how to register and maintain books of accounts for your business according to the BIR. Find out the requirements, steps, deadlines, and penalties for manual, loose-leaf, and .

Learn how to use BIR Form 1900 and other documents to register for Loose-Leaf Books of Accounts online via ORUS. Find out the requirements, steps, and recent updates for .

ALL persons engaged in trade or business, or in the practice of profession registered with the Bureau of Internal Revenue (BIR) are required to maintain books of accounts. The .Learn the steps to comply with the annual submission of loose leaf books of accounts to the Bureau of Internal Revenue (BIR). Find out the types of books, requirements, and deadlines .

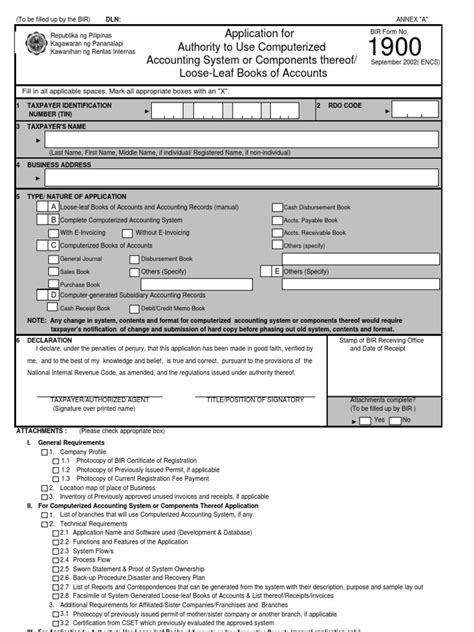

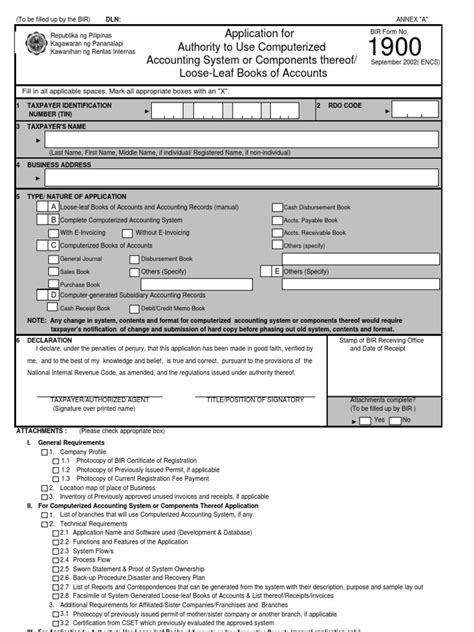

In applying for a loose-leaf book of accounts, taxpayers must file an application first for a “Permit to Use” (PTU) to their local BIR Revenue District Office. File the PROPER TAX FORMS — specifically, file a BIR Form 1900 (Application for Authority to Adopt Computerized Accounting System or Components Thereof/Loose-leaf .The application aims to obtain authorization from BIR to implement an accounting system. This document is an application for authority to use a computerized accounting system or loose-leaf books of accounts from the Bureau of Internal . BIR Form 1900 (Application to Use Loose-Leaf / Computerized Books of Accounts and/or Accounting Records) This is for freelancers and professionals who want to use loose . Duly Accomplished BIR Form 1900: This form is for Application for Authority to Use Computerized Accounting System or Loose-Leaf Books of Accounts. System-generated Books of Accounts: Provide samples of the pages of your proposed books of accounts. In Taxumo, once you have a subscription plan, just go to the “BOOKS” tab. Don't be confused with the different types of BIR forms every prescription period. This article provides a comprehensive view of the commonly used forms. . On the other hand, the 1900 and 1901 . BIR Form No. 1900 shall no longer be required for the submission of application for registration of the System. The "System" shall comply with the standard functional and technical requirements. Upon submission of complete documentary requirements, an Acknowledgement Certificate (AC) shall be issued within three (3) working days from receipt of . Duly accomplished BIR Form No. 1900; 2. Sample format and printout to be used; 3. In lieu of the investigation pursuant to RMC No. 13-82, a sworn statement specifying: (1) the books to be used, invoices/receipts and other accounting records together with the serial numbers of principal and supplementary invoices/receipts to be printed; and (2 .

If all the documents are complete, BIR will give you a received stamped copy of the BIR Form 1900. File the received stamped BIR Form 1900 for your copy and future reference. 3. Follow-up the Assessment and Release of Your Permit to Use (PTU) Looseleaf Official Receipt and/or Sales Invoice Certificate File the PROPER TAX FORMS — specifically, file a BIR Form 1900 (Application for Authority to Adopt Computerized Accounting System or Components Thereof/Loose-leaf Books of Accounts, 2002 Enhanced Version) and/or BIR Form 1907 (Application for Permit to Use Cash Register Machine/Point of Sale Machine, 2002 Enhanced Version). Prepare the . BIR Form 1900 (Application to Use Loose-Leaf / Computerized Books of Accounts and/or Accounting Records) This is for freelancers and professionals who want to use loose-leaf, computerized books of accounts, or accounting records. You have to submit this to your RDO. BIR Form 1906 (Application for Authority to Print Receipts and Invoices)

1. Write a letter of intent addressed to the BIR stating your intentions of using a loose-leaf book of account and the reason why. 2. Fill out the Application for Authority to Use Loose-Leaf Books of Account (BIR Form No. 1900) along with the following: i. A Photocopy of your BIR Certificate of Registration (BIR Form No. 2303) ii. BIR Form No. 1900 shall no longer be required. Though the system demonstration shall no longer be required prior to use, taxpayers shall ensure that the CAS/CBA and components thereof comply with the functional and technical .

Bir Form 1900 - Free download as Excel Spreadsheet (.xls), PDF File (.pdf), Text File (.txt) or read online for free. The document appears to be an application for a taxpayer to use a computerized accounting system or loose-leaf books of accounts for record keeping, as it requests information about the taxpayer including their TIN and address, the type of .

Accomplished BIR Form 1900 BIR Form 1900 (Application for Authority to Adopt Computerized Accounting System (CAS) and/or Components Thereof/Loose-leaf Books of Accounts, 2002 Enhanced version) and/or BIR Form 1907 BIR Form 1907 (Application for Permit to Use Cash Register Machine/Point of Sale Machine, 2002 Enhanced Version)1900 bir form An Ultimate Guide to Loose Leaf Books of Accounts: Application The beauty of BIR form 1900 lies in how it empowers the Bureau of Internal Revenue (BIR) to stay informed about the tax responsibilities of both businesses and individual taxpayers. It's essentially a bulwark against tax evasion, ensuring everyone, regardless of who they are or what they own, pays taxes that fairly correspond to their income .

APPLICATION FORMS; BIR Form No. 1900 : Application to Use Loose-Leaf / Computerized Books of Accounts and/or Accounting Records Description: . BIR Forms 1701Q / 1701 for individuals, or BIR Form 1702Q/ 1702 for non-individuals, in which case, the amount of withholding tax shall be allowed as a tax credit against the income tax liability of . BIR Form 1900 is the called the “Application for Authority to Use Computerized Accounting System or Components thereof/ Loose-Leaf Books of Accounts.” This form must be filled out and submitted together with the print outs of the typed-in records (usually in Excel format) when using the Loose Leaf method of Booking.1900 bir form A duly accomplished BIR Form 1900, which is the official application form for BIR CAS registration; Documents to validate the company’s profile such as its BIR Certificate of Registration, previously issued BIR permits, map with the business headquarters location, and a list of branches that will use the CASForm 1900 - Free download as PDF File (.pdf), Text File (.txt) or read online for free. This document is an application form for taxpayers to apply for authority to use a computerized accounting system or loose-leaf books of accounts from the Bureau of Internal Revenue (BIR) in the Philippines. The application requests information such as the taxpayer's identification .

Step 1: Fill out BIR Form 1900 and print out the 4 Books of Accounts reports from Taxumo. Step 2: Submit your Form 1900, together with your Certificate of Registration (COR), Letter of Intent, and printed Taxumo PRO reports for the 4 books to your BIR RDO officer.

1900 bir form|An Ultimate Guide to Loose Leaf Books of Accounts: Application

PH0 · Permit to use loose

PH1 · Permit to use Loose

PH2 · Loose Leaf Books of Accounts: Annual Submission

PH3 · How to apply for BIR Computerized Accounting System (CAS)

PH4 · DLN: ANNEX A Application for Authority to Use Computerized 1900

PH5 · Comprehensive Guide to BIR Forms for Businesses & Freelancers

PH6 · Comprehensive Guide to BIR Forms for Businesses

PH7 · Books of Accounts BIR: Guide to Registration, Filling Up, and

PH8 · BIR Form No. 1900

PH9 · An Ultimate Guide to Loose Leaf Books of Accounts: Application

PH10 · An Ultimate Guide to Loose Leaf Books of Accounts: Application

PH11 · A Guide to Loose Leaf Books of Accounts Application, etc.

PH12 · A Guide to Loose Leaf Books of Accounts Application, etc